After streaming officially overtook broadcast and cable TV in the U.S. last May – according to Nielsen’s The Gauge – this trend only strengthened over the summer. Streaming time climbed steadily, edging closer to a symbolic 50% share of total viewing (back in the summer of 2021, the figure was still just 28%).

Following the same methodology outlined in two earlier pieces published in June and July, we continue our monitoring of the shows that are driving streaming’s growth most in 2025 in the U.S. market. This time, the focus is on the summer season – specifically the 13 weeks between May 26 and August 24 – drawing not only on Nielsen’s overall charts (used in our previous analyses) but also on the weekly Top 10 rankings compiled by Samba TV.

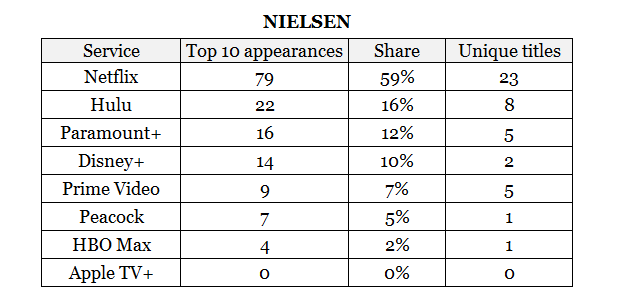

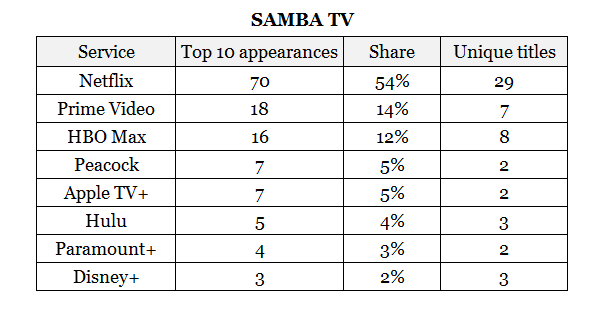

While based on different technologies and analytical tools – which makes direct comparisons impossible – Nielsen and Samba TV together provide a sufficiently broad picture of current viewing trends on connected TVs. To frame the data correctly, it’s worth noting one major difference between the two systems: Samba TV reports each season of a series separately, while Nielsen aggregates them. In practice, this means Nielsen’s charts tend to favor long-running series with multiple seasons – which continue to attract viewing, especially around the release of new episodes – whereas Samba TV’s rankings highlight more clearly the performance of newly released seasons.

The Hierarchy Among SVOD Services

Before diving into the top summer titles, let’s first examine the pecking order among OTT services, based on the number of weekly appearances in the charts during the period under review. The tables below show each platform’s overall presence, its percentage share, and the count of unique titles (i.e. excluding repeated appearances across multiple weeks).

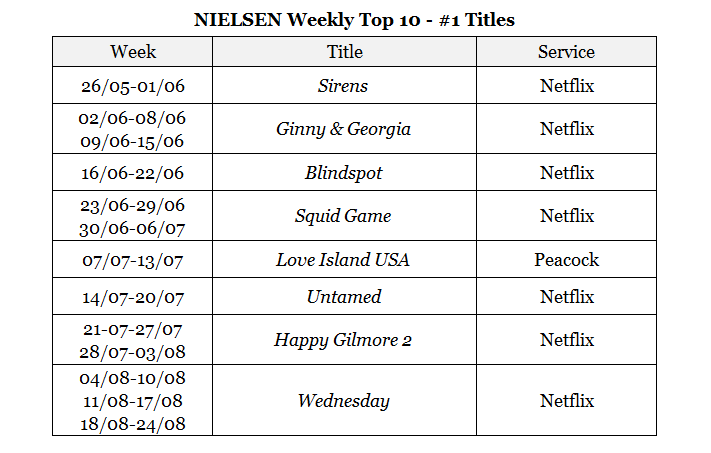

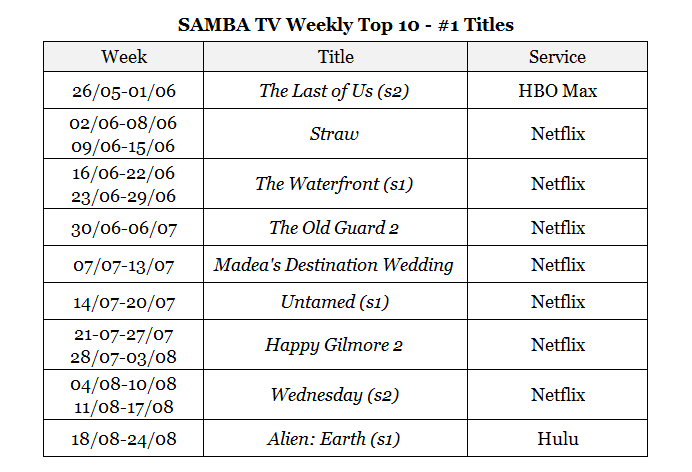

Both Nielsen and Samba TV confirm – once again and beyond any doubt – the dominance of Netflix among SVOD platforms. In a typical week, at least half of the ranked titles are available on Netflix. The service also secured the number one position in 12 of the 13 weeks tracked by Nielsen, and in 11 according to Samba TV.

The rest of the market appears far more fragmented, due in part to methodological differences between Nielsen and Samba TV. Nielsen’s data, for instance, tends to favor services like Hulu and Paramount+, which often enter the Top 10 thanks to catalog staples such as Grey’s Anatomy and NCIS. Yet, when those shows are also available on Netflix, Netflix almost certainly drives the bulk of consumption.

Other notable discrepancies between the two systems concern the performance of HBO Max, Apple TV+ and Prime Video, which Samba TV ranks higher, thanks to the success of certain titles that, as we will see shortly, never appear in Nielsen’s Top 10.

Nielsen’s Top 10 Titles

Across the 13 summer weeks under review, 38 titles appeared at least once in Nielsen’s overall rankings: 8 films and 30 series (the total count of unique titles differs from the table shown, due to certain titles being available simultaneously across multiple services).

Alongside the animated series Bluey (Disney+) – the only title to feature in every single week of 2025 so far – the standout performer was, unsurprisingly, the animated film KPop Demon Hunters. Produced by Sony but released directly on Netflix on June 20, the movie held a spot in the Top 10 for 8 weeks. It first entered the chart in late June at number ten, before cementing its presence from July 7 onward.

So far this year, the only other title besides Bluey to reach eight weeks in Nielsen’s Top 10 was The White Lotus (HBO Max). That show, however, had the advantage of a longer runtime – with two prior seasons available – as well as a weekly release schedule. By contrast, the sheer reach of KPop Demon Hunters is harder to explain, yet it once again underlines Netflix’s unique position in today’s attention economy: without relying on pre-existing IP, the film managed to eclipse the season’s big-screen blockbusters. It even grossed nearly $20 million in just two days of theatrical screenings of a “sing-along” version, more than two months after its streaming debut.

Turning to series, one of the most remarkable performers was Love Island USA, one of the very few unscripted titles to make the 2025 Top 10. Now in its seventh season and streaming on Peacock, the reality show charted for seven weeks and even claimed the number-one spot from July 7 to 13. Among scripted content, the most enduring title was the romantic drama Sullivan’s Crossing, available on Netflix, which remained in the Top 10 for six weeks. Co-produced by Canadian broadcaster CTV and The CW, the show’s performance further highlights Netflix’s ability to extend the life cycle of broadcast content.

Finally, among the titles that reached the top of the chart more than once, all belonged to Netflix. The film Happy Gilmore 2, the series Ginny & Georgia (3 seasons) and Squid Game (3 seasons) – the only non-English title included in this analysis – each held the number-one position for two consecutive weeks. Meanwhile, Wednesday (2 seasons) confirmed its status as a global phenomenon, topping the chart for three weeks in a row.

Samba TV’s Top 10 Titles

According to Samba TV’s data, 56 unique titles entered the Top 10 at least once during the summer period: 34 television series and 22 films.

As noted earlier, the higher turnover in Samba TV’s rankings stems from its decision to track viewing by individual season, as well as from structural differences in measurement methodology. As a result, the charts do not feature long-running evergreens like Bluey or Grey’s Anatomy – fixtures of Nielsen’s Top 10 – but rather highlight the biggest new releases of the season.

The most enduring title was once again KPop Demon Hunters, which appeared in 8 of the 13 weeks analyzed (the movie continued to appear in Samba TV’s Top 10 for four additional weeks beyond the observation window, not included here in order to align the timeframe with Nielsen’s data, which is released about a month later and only goes through August 24). As with Nielsen, the film first entered the chart during the week of June 23–29, dropped out the following week, and then re-emerged decisively from the second week of July onward.

Beyond the dominance of KPop Demon Hunters, several strong performers in Samba TV’s rankings appeared less frequently, or not at all, in Nielsen’s Top 10. Prime Video’s teen drama The Summer I Turned Pretty, for instance, appeared only twice in Nielsen’s charts, but spent six weeks among the most-watched titles according to Samba TV.

Even more notable are Apple TV+’s new series Stick and the third season of HBO Max’s period drama The Gilded Age. Both failed to break into Nielsen’s Top 10, yet were present in Samba TV’s charts six and five times respectively.

Finally, when it comes to titles that reached the number-one spot more than once, Netflix’s dominance is again evident. In addition to Happy Gilmore 2 and Wednesday 2, both Straw and the new series The Waterfront also held the top position for two consecutive weeks.The Waterfront also held the top position for two consecutive weeks.

(Giovanni Ceccatelli)